Fourth Money Laundering Directive Eu

The EUs 4th Anti-Money Laundering Directive 4th EU AML Directive was enacted on 25 June 2015 and fully implemented on the 26 June 2017 replacing the third Anti-Money Laundering Directive. It will replace the Third Money Laundering Directive.

Revision Of The Fourth Anti Money Laundering Directive Eu Legislation In Progress Epthinktank European Parliament

What is 4th AML Directive and how it affect my company organization.

Fourth money laundering directive eu. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. 5 May 2021 Author. The European Union Fourth Money Laundering Directive 4AMLD was ratified by the European Parliament in 2015 and was implemented in all EU states on the 26th June 2017.

It was implemented in all of the states of the European Union on 26th June 2017. The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. The Fourth AML Directive is a legislation passed by the European Union and ratified by the European Parliament in 2015.

It takes into account the 40 new recommendations adopted by the Financial Action Task Force FATF on 16 February 2012 which the EU Member States have committed to. On 20 July 2021 the European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rulesThe package also includes a proposal for the creation of a new EU authority to fight money laundering. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive.

It was transposed into UK law on the same date via the The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. 5 th anti-money laundering Directive. This is a significant expansion of the definition of beneficial owner in the fourth EU Money Laundering Directive as well as currently applicable law in Germany and the vast majority of other EU Member States.

The Directive was translated into. On June 26th the MLD4 came into force. According to current German law ownership of more than 25 of the shares or voting rights was sufficient to identify the beneficial.

That Directive which had a transposition deadline of 26 June 2017 sets out an efficient and comprehensive legal framework for addressing the collection of. The delegated regulation amends delegated Regulation EU. The Fourth Money Laundering Directive EU 2015849 MLD4 is designed to strengthen the EUs defences against money laundering and terrorist financing while also ensuring that the EU framework is aligned with the Financial Action Task Forces FATF international anti-money laundering AML and counter-terrorist financing CTF standardsMLD4 repealed and replaced the Third Money.

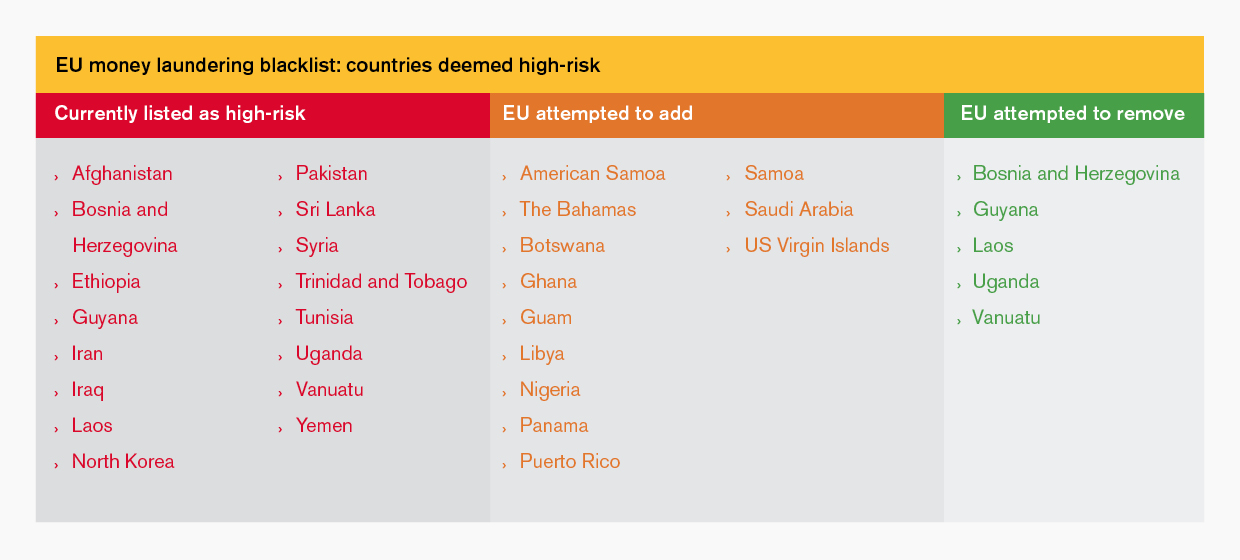

DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and reputation of the financial sector and. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering Directive and aiming at protecting the Union financial system and the proper functioning of the internal market. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018.

In the wake of nancial crises scandals and massive tax evasion the EU took its ght against Money Laundering to the next level. 1 Directive EU 2015849 of the European Parliament and of the Council 4 constitutes the main legal instrument in the prevention of the use of the Union financial system for the purposes of money laundering and terrorist financing. As well as a greater emphasis on risk assessments to combat money laundering AML and terrorist financing CTF at every level the Directive further enhances.

Financial Stability Financial Services and Capital Markets Union. Kamil Jaworski Kamil Jaworski. What is the Fourth Anti-Money Laundering Directive 4AMLD.

This Directive is the fourth directive to address the threat of money laundering. 05 October 2020 last update on. Hopes lie in the implementation of the Fourth Money Laundering Directive MLD4 in 2017.

Article 301 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owners in their own internal. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC. 2 Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and the Council and repealing Directive 200560EC of the European Parliament.

Banking and financial services. The Member States had to transpose this Directive by 10 January 2020. EUs 6th Anti-Money Laundering Directive.

The 4th Eu Anti Money Laundering Directive And You

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

Eu Policy On High Risk Third Countries European Commission

4th Anti Money Laundering Directive 4amld Coinfirm

4th Eu Money Laundering Directive A Practical Guide From Actico

What Does Europe S Anti Money Laundering Overhaul Mean For Trade Finance Global Trade Review Gtr

The Fourth Anti Money Laundering Directive Eu 2015 849 Of The European Parliament And Of The Council Of 20 May 2015

Assessment Of Effective Application Of The 4th Eu Anti Money Laundering Directive Start Of The Process Newsroom 4amld

A Summary Of Eu Anti Money Laundering Directives Complyadvantage

Http Www Europarl Europa Eu Regdata Etudes Brie 2017 607260 Eprs Bri 2017 607260 En Pdf

4th Eu Money Laundering Directive A Practical Guide From Actico

Project To Assess Compliance Of Eu Member States With The 4th Eu Anti Money Laundering Directive 4amld Project

Eu S 4th Aml Directive Aims To Make The Payment Ecosystem Crime Free

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

Key Elements Of The 4th Eu Anti Money Laundering Directive Financier Worldwide

4th Eu Money Laundering Directive A Practical Guide From Actico

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

Post a Comment for "Fourth Money Laundering Directive Eu"