Aml Definition Banking

Finanzinstitutionen und andere regulierte Einheiten mssen ber ein robustes Programm zur Verhinderung Aufdeckung und Meldung von Geldwsche. Specifically the risk-based approach requires the identification and assessment of the individual risk at hand application of specific mitigation and monitoring measures and documentation of the strategy taken and any.

Difference Between Kyc And Aml Tookitaki Tookitaki

The European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules.

Aml definition banking. Once adopted these Guidelines will apply to all. Administrative Meldung zur Strafverfolgung. Trusts and offshore companies useful for hiding the identity of the real beneficial owners.

Recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. Die AMLCFT-Leitlinien der EIB-Gruppe gelten fr alle Operationen und Ttigkeiten der EIB-Gruppe die in den jeweils geltenden einschlgigen Prozessanweisungen aufgefhrt sind. Smurfing lodging small amounts of money below the AML reporting threshold to bank accounts or credit cards then using these to pay expenses etc.

Einem MDS s-AML entstehen. Often associated with ethnic groups from the Middle East Africa or Asia and commonly involves the transfer of values among countries outside of the formal banking system. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions.

AML policies help banks and financial institutions combat financial crimes. The European Banking Authority EBA launched today a public consultation on new Guidelines on the role tasks and responsibilities of anti-money laundering and countering the financing of terrorism AMLCFT compliance officers. The Guidelines also include provisions on the wider AMLCFT governance set-up including at the level of the group.

Als Geldwsche gelten a der Umtausch oder Transfer von Vermgensgegenstnden in Kenntnis der Tatsache dass diese. Banks AMLCFT measures and related supervision should follow a risk-based approach. 23 Definition von Geldwsche.

Is an independentlaundering AML and counter-terrorist financingFor more information about the FATF please visit money laundering terrorist inter-governmental body that develops and promotes Recommendations are recognised financing the financing anti-money of standard. Generally speaking an adjustable rate mortgage is linked to some major benchmark rate. This entails a differentiation of risk classes and their separate management.

It also proposes the creation of a new EU authority to fight money laundering. Concerns about money laundering or terrorist financing especially concerns stemming from AMLCFT authorities assessments of MLTF risks associated with individual. Foreign bank accounts physically taking small amounts of cash abroad below the customs declaration threshold lodging in foreign bank accounts.

For more information about the FATF please visit the website. Alternative Remittance System ARS Underground banking or Informal Value Transfer Systems IVTS. Bei Kindern unter 15 Jahren machen AML nur etwa 15-20 der akuten.

Was ist AML Prvention von Geldwsche. Financial to protectproliferation of weapons destruction. Adjustable Rate Mortgage A mortgage with an interest rate that changes periodically.

AML knnen entweder de novo nach einer vorausgegangenen zytotoxischen undoder Strahlentherapie t-AML oder sekundr aus einer vorbestehenden myeloproliferativen Erkrankung bzw. The package harmonises AMLCFT rules across the EU. For example the interest rate may be stated as LIBOR 1.

Kontrollen zur Bekmpfung von Geldwsche sollen Finanzkriminelle daran hindern illegal erworbene Gelder als rechtmige Gelder zu verschleiern. Das mediane Alter liegt bei 65 Jahren. In this context ECB Banking Supervision in the exercise of its prudential supervisory tasks shall act upon money laundering and terrorist financing MLTF concerns that may have an impact on an institutions safety and soundness.

AML is a set of regulations laws and procedures that detect and prevent criminals from disguising illegal funds as legitimate income. Die Inzidenz der AML liegt bei 25 30 100000 Einwohner pro Jahr.

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

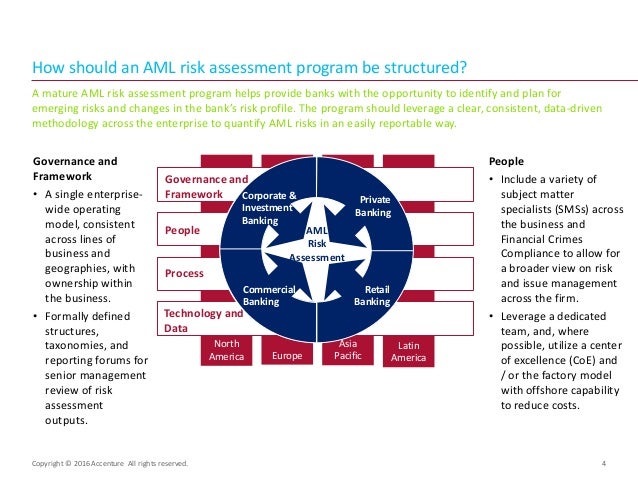

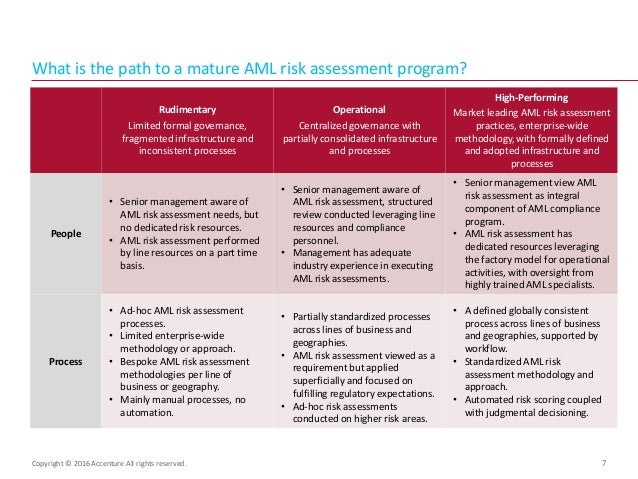

Anti Money Laundering Aml Risk Assessment Process

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Aml Software Bsa Compliance Fraud Prevention Software Abrigo

Anti Money Laundering Aml Risk Assessment Process

What Is The Aml Process In Banking Quora

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Fincen Plans Major Overhaul Of Anti Money Laundering Rules American Banker

An Introduction To The 360 Degree Aml Investigation Model Acams Today

What Is The Difference Between Kyc And Aml Cdd Edd Justcoded

What Is Aml Kyc In Crypto Sygna

Insurance Anti Money Laundering

What Is Enhanced Due Diligence In Banking Plianced Inc

Concept Of Correspondent Banking For Cams Examination Preparation

Anti Money Laundering Overview Process And History

The 4 Quadrants Of Politically Exposed Persons Complyadvantage

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

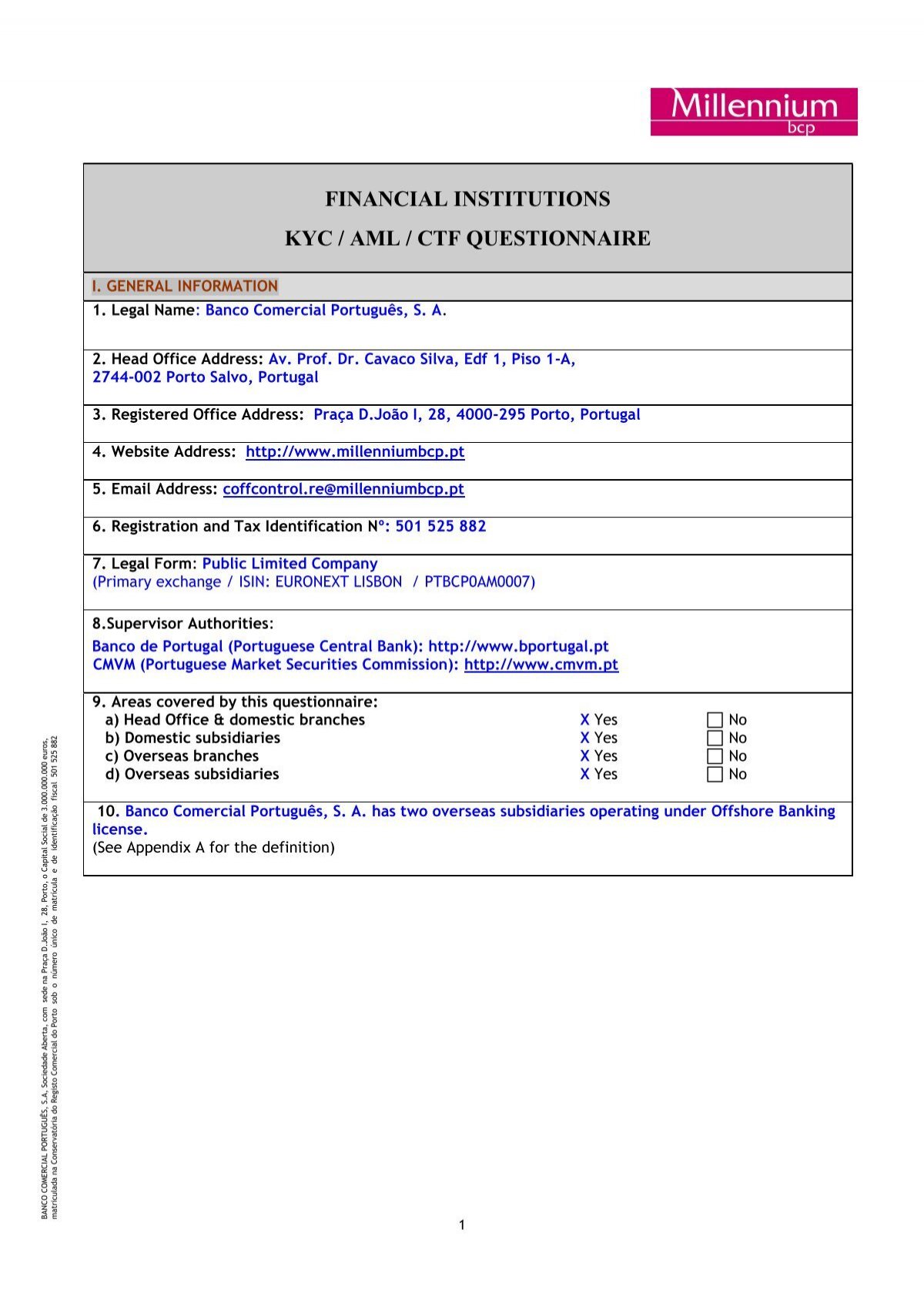

Financial Institutions Kyc Aml Ctf Questionnaire Millennium Bcp

Post a Comment for "Aml Definition Banking"