Compound Interest Non Calculator

Enter an initial balance figure. Using this compound interest calculator Try your calculations both with and without a monthly contribution say 50 to 200 depending on what you can afford.

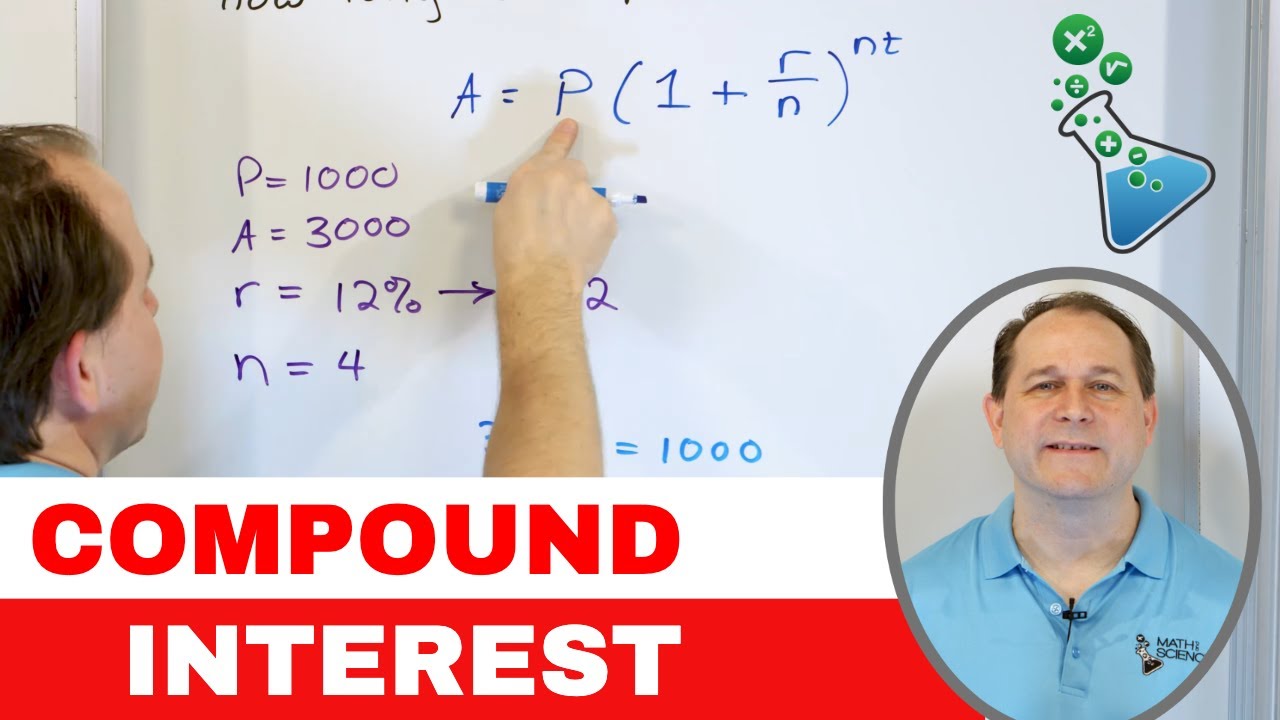

26 Compound Interest Formula Exponential Growth Of Money Part 1 Calculate Compound Interest Youtube

Interest rate - the rate the money grows at.

Compound interest non calculator. Calculate NowUnderstanding Compound Interest Investing Strategies. Enter the principal amount interest rate time period and click Calculate to retrieve the interest. The former offers a monetary benefit based on the principal amount of the investment while the latter pays interest earned upon accumulated interest.

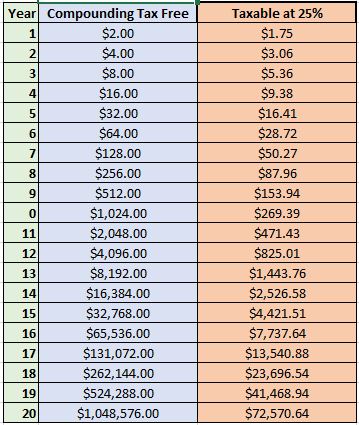

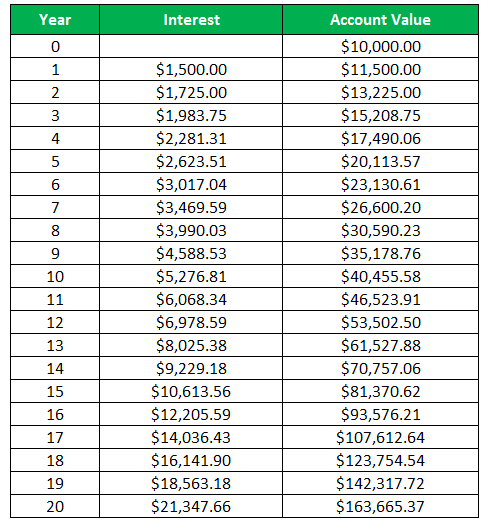

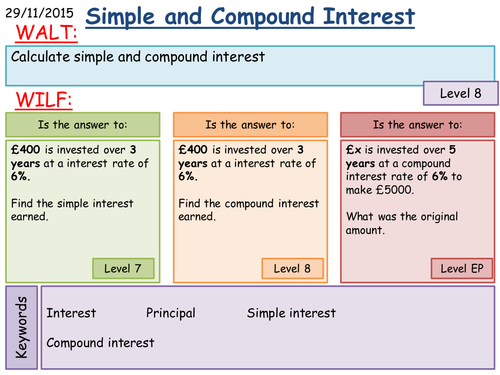

Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Compound Interest means that you earn interest on your interest while Simple Interest means that you dont - your interest payments stay constant at a fixed percentage of the original principal.

First a calculator to let you see the difference. Use the Compound Interest Calculator to learn more about or do calculations involving compound interest. Heres how to use it.

Even small deposits to a. The lesson is that compound interest is a better investment which. From the graph below we can see how an investment of Rs 100000 has grown in 5 years.

An investment of Rs 100000 at a 12 rate of return for 5 years compounded annually will be Rs 176234. The simple interest or. Enter a number of years or months or a combination of both for the calculation.

If you start with 10000 in a savings account earning a 7 interest rate compounded annually and make 100 deposits on a monthly basis after 20 years your savings account will have grown to 8973745 - of which 34000 is the total of your beginning balance plus deposits and 5573745 are the total interest earnings. To improve this Compound Interest FV Calculator please fill in questionnaire. Our compound interest calculator gives you a future balance and a projected monthly and yearly breakdown for the time period.

Range of interest rates above and below the rate set above that you desire to. This interest calculator not only shows you the affects of simple monthly interest but it also shows you the future value if interest is compounded every month. The term of the loan can affect the structure of the loan in many ways.

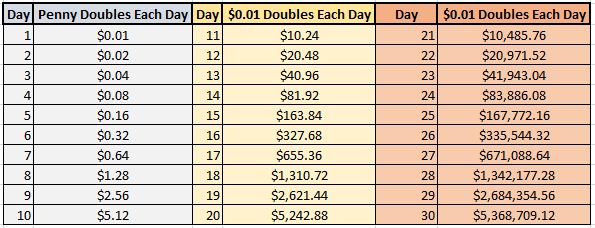

Compound Daily Interest Calculator. The more frequent the contributions the more it grows. It covers how to approach calculator and non-calculator questionsPractice Questions.

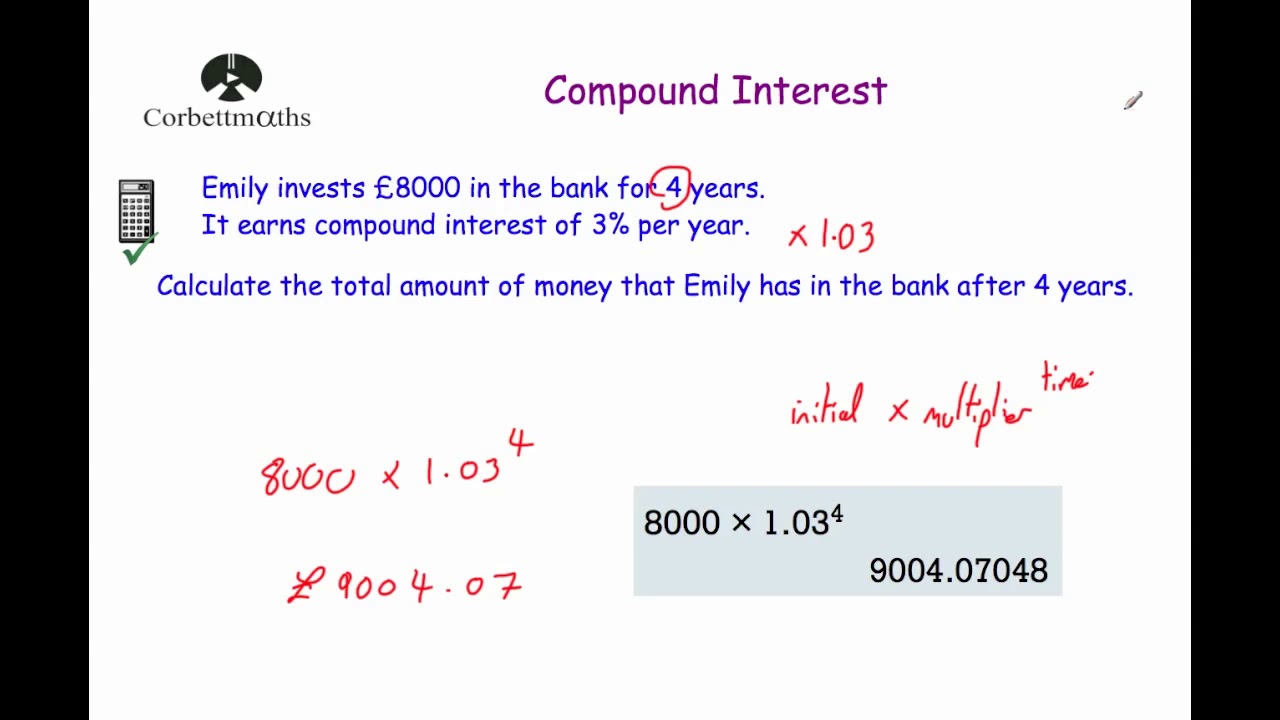

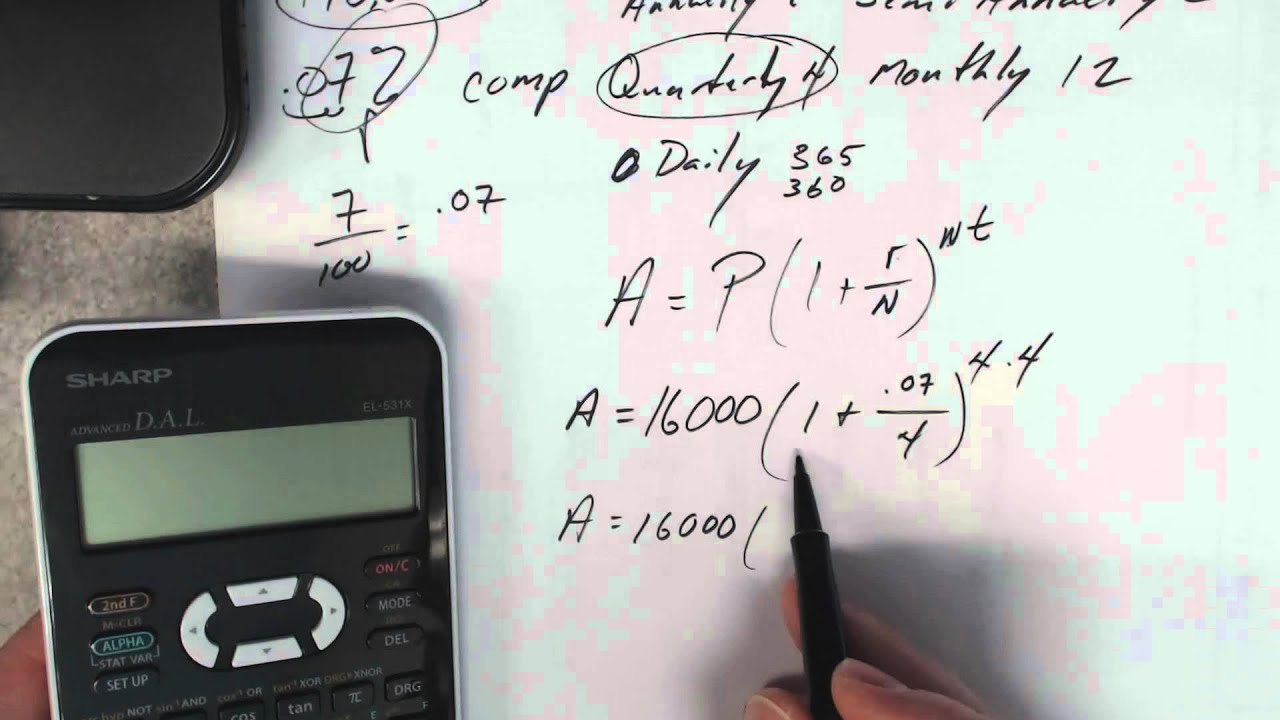

Your estimated annual interest rate. Enter a percentage interest rate - either yearly monthly weekly or daily. This video explains how to answer compound interest questions.

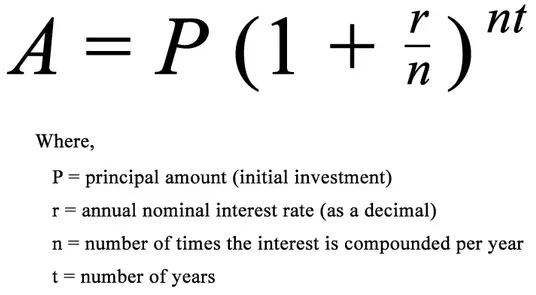

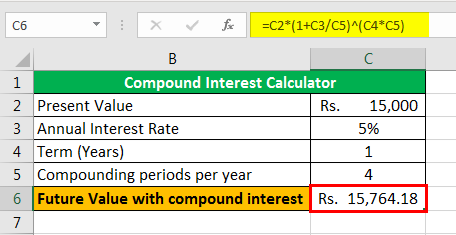

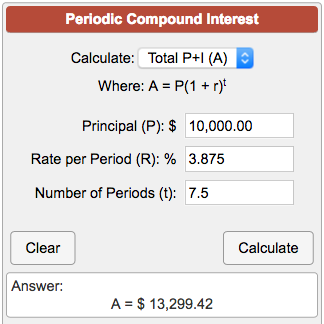

A the future value of the investment. Continuous compounding A Pert. Use compound interest formula AP1 rnnt to find interest principal rate time and total investment value.

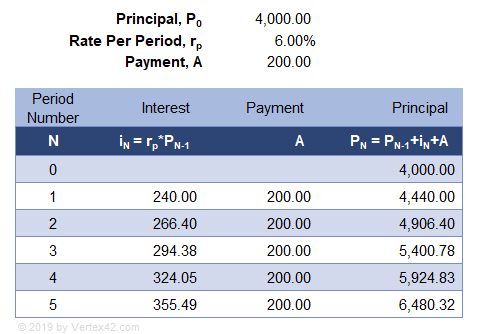

The formula used for daily compound interest with a fixed daily interest rate is. Age Under 20 years old 20 years old level 30 years old level 40 years old level 50 years old level 60 years old level or over Occupation Elementary school Junior high-school student. Compound Interest P 1 i n 1 P is principal I is the interest rate n is the number of compounding periods.

Choose what you would like to calculate. Compound interest calculator finds compound interest earned on an investment or paid on a loan. P the principal investment amount.

A P 1rt. Term - how many years to compound. An average annual return in a conservative portfolio with 50 bonds and 50 stocks might be 5.

Compound Frequency - how often does the balance compound yearly quarterly monthly twice monthly. A loan term is the duration of the loan given that required minimum payments are made each month. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Choose an investment such as a savings account or other financial product with a high interest rate that compounds youll be glad you did. In the world of financial instruments the most common types of interest formulations offered are simple and compound. Generally the longer the term the more interest will be.

Interest rate variance range. R the daily interest rate decimal t the number of days the money is invested for. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629 -- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total.

Select the currency from the drop-down list this step is optional. To use our calculator simply.

The Best Compound Interest Account For Maximum Growth And Control

Compound Interest Corbettmaths Youtube

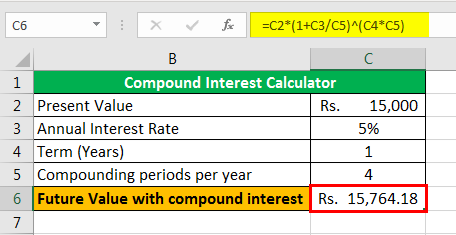

Compound Interest Calculator For Excel

Compound Interest And Depreciation Youtube

Interest Formula Calculator Examples With Excel Template

Maths Ks4 Compound Interest Teaching Resources

The Continuous Compound Interest Formula Excel Function For Nerds Like Us

The Best Compound Interest Account For Maximum Growth And Control

How To Compute Compound Interest In Your Calculator Youtube

Compound Interest Formula In Excel Step By Step Calculation Examples

Excel Formula Calculate Compound Interest Exceljet

Periodic Compound Interest Calculator

How Do I Calculate Compound Interest Using Excel

Compound Interest Example Practical Examples With Formula

Simple Compound And Continuous Interests Maple Help

Which Is Better Simple Or Compound Interest Rate In Fd

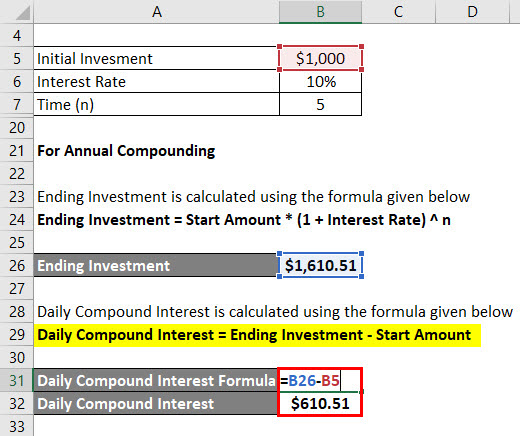

Daily Compound Interest Formula Calculator Excel Template

Post a Comment for "Compound Interest Non Calculator"